Bitwise Europe’s bullish forecast for Solana highlights its potential to capture 11% of global blockchain users, driving its price up 30x by 2030.

According to a January 2025 Bitwise report, Bitwise Europe has set forth a positive projection for Solana SOL, suggesting a colossal price uptick from the current price of $212 as of Jan. 17 to $6,636 by 2030, marking a growth of over 3,000%, primarily based on what researchers are calling “the iPhone moment”.

Bitwise Europe compared Solana’s debut to that of the iPhone in 2007. Solana has built fast, cost-effective, and user-friendly platforms so non-blockchain people can thrive, much like the iPhone introduced mobile technology to the masses, discusses Bitwise Europe.

The report states that Solana’s current market share is at 2.84%, and it is expected to capture 11.36% of global blockchain users, which means 113.6 million daily active addresses.

With expanding mainstream partnerships with key players like Shopify and Stripe, and a thriving developer ecosystem, Solana’s network could see significant expansion, according to Bitwise Europe.

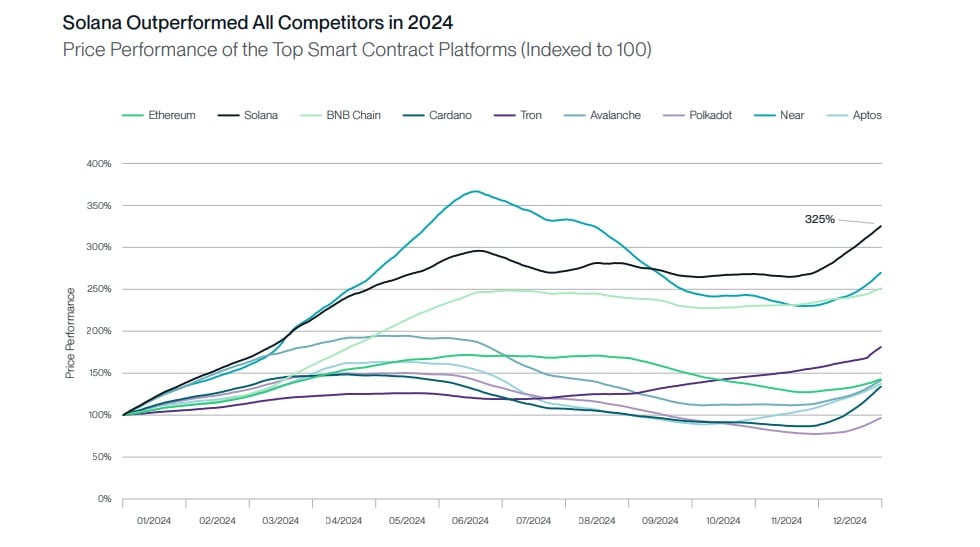

This optimism is rooted in the network’s growth, which includes a 239% increase in daily active accounts in 2023 despite challenging market conditions, and an explosive 2,800% growth in early 2024.

According to the report, this level of efficiency beats nearly every Layer-2 in the Ethereum (ETH) chain. SOL is able to attract developers who are building decentralized applications on its chain. This is because developers cannot only deploy faster but can serve a wider audience.

SOL’s technical architecture allows high-volume, low-latency applications from decentralized exchanges, real-time trading, large-scale gaming, and high-frequency trading to real-time data streaming, says the report.

For instance, Serum, a decentralized exchange running on Solana, revealed in their roadmap 2.0 that the platform would bring DeFi to the masses. Further, Raydium, an automated market maker on the Solana blockchain, had the highest monthly volume in November 2024 at 83.6 billion, as per DeFiLlama.

Bitwise Europe credits Solana for supporting a theoretical maximum of 65,000 transactions per second–a measure of how many individual operations a network can process in one second– with transaction costs averaging just $0.08, making these applications economically viable.

Earlier this week, on Jan. 15, Franklin Templeton published a report showcasing how seven out of the top ten AI agents run on the Solana blockchain, largely attributed to Solana’s ability to handle large volumes of transactions efficiently and at lower costs.