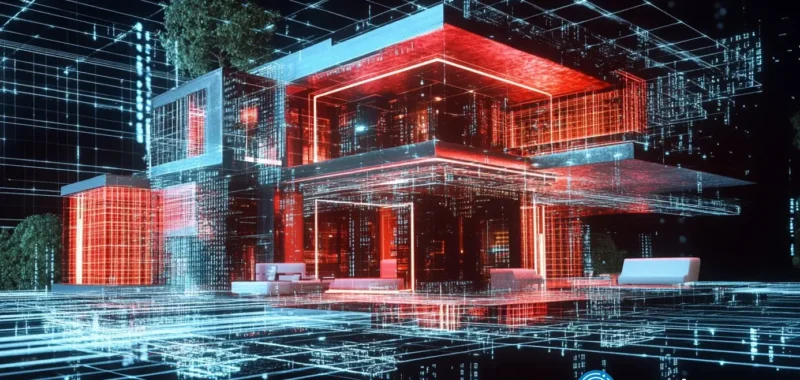

Blocksquare and Vera Capital are launching a $1 billion effort to bring U.S. real estate on-chain.

The partnership will tokenize a portfolio of commercial and multifamily properties across the country using Blocksquare’s blockchain-based infrastructure, according to a release shared with crypto.news.

The first property, a $5.4 million commercial asset in Fort Lauderdale, has already been tokenized. Vera Capital plans to launch a digital marketplace that will allow global investors to buy tokenized shares in U.S. properties.

Blocksquare’s white-label technology will power the platform.

Tokenization is the process of converting real estate ownership rights into digital tokens recorded on a blockchain. These tokens represent fractional ownership in physical properties. The goal is to make it easier for people around the world to invest in U.S. real estate without needing to purchase entire buildings or rely on traditional financial institutions.

Blocksquare’s Oceanpoint Launchpad support

Vera Capital qualified for this infrastructure through Blocksquare’s Oceanpoint Launchpad, where it received over 100,000 staked $BST tokens from supporters in under an hour. This early success gave Vera free access to Blocksquare’s full technology stack and marketplace tools.

In exchange, participants who staked their tokens are rewarded with new tokens, a process common in decentralized finance projects.

Vera Capital, founded in 2012, manages over $100 million in real estate and offers services including brokerage, development, property management, and investment. The firm’s upcoming marketplace will begin with dozens of properties across seven U.S. states.

The move signals increasing interest in tokenizing real-world assets and could help expand access to institutional-grade real estate for smaller, global investors.