MicroStrategy’s top 100 breakthrough is fueled by Bitcoin — and fueling Bitcoin in return. How does this feedback loop keep pushing both higher?

MicroStrategy joins the top 100 Club

MicroStrategy (MSTR), a company famously tied to Bitcoin’s (BTC) wild journey, just hit a major milestone. As of Nov. 20 trading session, it has jumped 48 places in two days, landing at 85th in the exclusive club of the top 100 publicly traded U.S. companies by market cap.

As of Nov. 20, MSTR’s market cap has climbed to nearly $111 billion following a 12% surge in its stock price on Nov. 19, coupled with an additional 15% gain as of this writing. Currently, the stock is trading at $482 per share, marking a remarkable close to an already explosive year of growth.

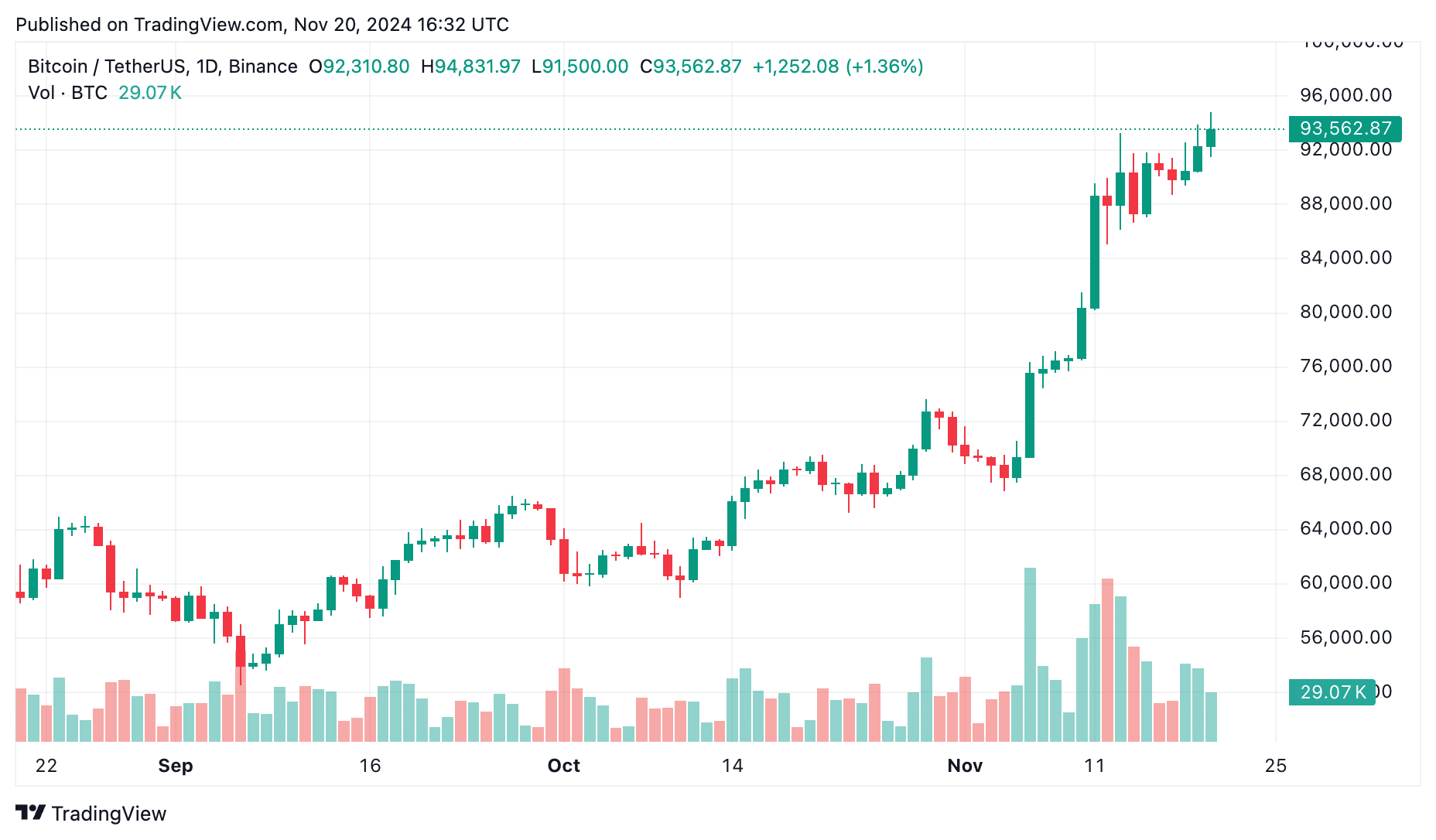

Concurrently, Bitcoin — the cornerstone of MicroStrategy’s corporate strategy—has soared to a fresh all-time high, breaking $94,000 and trading at $94,850 as of Nov. 20.

For context, MicroStrategy’s stock has skyrocketed 620% year-to-date in 2024, while BTC itself is up over 125%.

Since adopting Bitcoin as a treasury asset in 2020, MicroStrategy’s stock has soared an astonishing 2,739%, narrowly surpassing NVIDIA’s (NVDA) 2,688% gain over the same period, reshaping how Bitcoin-heavy strategies are pushing MSTR into a league dominated by tech giants, banks, and energy conglomerates.

This feat places MSTR ahead of NVDA—currently the world’s largest publicly traded company with a market cap exceeding $3.6 trillion and celebrated as a leader in artificial intelligence and gaming innovation—when comparing performance over the last five years.

So, what does this all mean for Bitcoin? Let’s dig deeper into the relationship between MSTR and Bitcoin and explore how their paths influence each other in ways that might just be rewriting financial history.

How MicroStrategy became Bitcoin’s biggest backer

MicroStrategy has redefined its identity over the past few years, evolving from a business software company to a leader in corporate Bitcoin adoption. Its strategy is straightforward: accumulate as much Bitcoin as possible and leverage it as a long-term asset.

Since its first purchase in 2020, MicroStrategy has continued to expand its Bitcoin reserves through bold acquisitions and innovative funding methods, tying its growth closely to the performance of BTC.

As of Nov. 20, the company holds approximately 331,200 BTC, acquired at a total cost of $16.5 billion, or an average price of $49,874 per Bitcoin.

Amid the current bull run, the company purchased 51,780 BTC for $4.6 billion between Nov. 11 and Nov. 17, at an average price of $88,627 per Bitcoin.

MSTR’s BTC holdings, now valued at over $31 billion, are more than 10 times the Bitcoin holdings of Marathon Digital (MARA), the second-largest public holder with around 27,000 BTC, and far exceed Tesla’s 11,500 BTC.

To fund its acquisitions, MicroStrategy relies heavily on capital-raising strategies. On Nov. 18, the company disclosed in an SEC filing that it sold approximately 13.6 million shares for net proceeds of $4.6 billion under a pre-existing agreement.

Despite this, it still has $15.3 billion in shares available for future issuance, giving it significant flexibility for continued investment in Bitcoin.

And the company isn’t done making bold moves. Just two days ago, MicroStrategy unveiled a $1.75 billion convertible senior note, set to mature in December 2029, with a 0% coupon rate.

Convertible senior notes are a unique type of debt instrument that allows investors to lend money to a company with the option to convert that debt into shares at a later date, typically at a pre-agreed price.

What’s intriguing here is that MicroStrategy’s notes come with a 0% coupon rate, meaning they don’t pay any regular interest to investors.

In a new twist, MicroStrategy announced that due to high demand, it had upsized the convertible bond offering from $1.75 billion to $2.6 billion, including a $400 million greenshoe option, with a 55% conversion premium.

The greenshoe option — commonly used to accommodate excess demand — gives underwriters the ability to sell additional bonds beyond the initial offering. The 55% conversion premium represents the percentage above MicroStrategy’s current stock price at which the bonds can be converted into shares.

It shows that investors are willing to pay a substantial premium to bet on the company’s long-term growth, even as its stock continues to rise — essentially tying their fortunes to the company’s Bitcoin-driven strategy.

A vision beyond Bitcoin holdings

MicroStrategy’s story is far from finished, and its next chapter is shaping up to be even more audacious than the last.

MicroStrategy’s leadership, led by Executive Chairman Michael Saylor, isn’t content with simply making Bitcoin a cornerstone of its own strategy—it’s working to bring this vision to the broader corporate world.

On Nov. 19, Saylor confirmed during an X Spaces hosted by VanEck that he would deliver a three-minute presentation to Microsoft’s board of directors to advocate for the adoption of BTC as part of their investment strategy.

Saylor has openly stated that he believes Bitcoin should be on the agenda for every major corporation, from Apple and Meta to Berkshire Hathaway.

Saylor argues that holding Bitcoin as a tangible asset could help companies stabilize their stock value, particularly when compared to relying heavily on quarterly earnings performance.

For instance, Microsoft’s enterprise value is currently tied to 98.5% of its earnings, with only a small fraction supported by tangible assets. Saylor believes BTC could offer a more balanced approach, potentially preserving shareholder value over the long term.

Beyond influencing others, MicroStrategy is doubling down on its own Bitcoin strategy with a bold initiative called the “21/21 Plan.”

Announced in late October, this ambitious plan aims to raise $42 billion over the next three years—$21 billion through equity and another $21 billion through debt. The goal is to buy more BTC and solidify its position as the world’s leading Bitcoin treasury company.

According to CEO Phong Le, the capital raised will allow MicroStrategy to deploy its BTC more strategically, creating opportunities for higher returns while maintaining a strong reserve.

The Bitcoin-MSTR feedback loop

MicroStrategy’s strategy has created a fascinating — and controversial — feedback loop that ties its performance directly to Bitcoin’s trajectory, amplifying both assets in the process.

The more Bitcoin MicroStrategy buys, the tighter the circulating supply becomes, pushing Bitcoin’s price higher, especially in bullish markets. The company’s stock, fueled by the rising value of its Bitcoin holdings, attracts further investor interest, boosting its price.

A higher stock price allows MicroStrategy to raise more capital through share sales or debt, and that capital is channeled into—buying even more Bitcoin.

It’s a cycle that feeds on itself, and while it’s proven highly effective so far, it also raises important questions about its sustainability.

Critics are beginning to sound the alarm over how sustainable this strategy is. For example, Peter Schiff, a well-known Bitcoin sceptic, has questioned whether this self-reinforcing cycle is creating an unsustainable bubble.

But what makes this feedback loop particularly unique — and potentially risky — is the scale of MicroStrategy’s Bitcoin holdings.

The company now controls over 1% of Bitcoin’s total supply, a staggering figure that gives it outsized influence on the market. Every major purchase tightens the available supply, potentially triggering upward price pressure on BTC’s price.

If MicroStrategy’s strategy succeeds, it could encourage other companies to follow suit, amplifying the cycle further. But if Bitcoin’s price falters, the entire mechanism could unwind, with both the stock and Bitcoin suffering as a result.

This also means that Bitcoin’s price is increasingly tied to the actions of large institutional players like MicroStrategy, which didn’t exist in its early days as a decentralized asset.

The bigger question is whether this symbiotic relationship between MicroStrategy and Bitcoin can remain beneficial in the long term — or whether it’s a fragile structure that depends too heavily on perpetual upward momentum.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.