Users were confused by the news that FTX clients would receive between 10% and 25% of the value of the deposited crypto assets. Why did this happen?

Sunil Kavuri, one of the creditors, recently said several other changes are also planned in the reorganization plan. One of the points, which concerns the amount of compensation payments to victims, raised questions in the community.

What is known about the compensation plan

Crypto assets deposited on the platform will be valued at the rate when filing for bankruptcy. Therefore, the actual compensation will be between 10% and 25% of the market value of their cryptocurrency.

FTX shareholders will also receive an additional 18% of the funds confiscated by the U.S. Department of Justice, but no more than $230 million. This became an additional clause on increasing the share of preferred shareholders.

However, many expressed dissatisfaction with the terms of the payments, calling it a scam. One user suggested this payment schedule may be because most FTX shareholders are either Sullivan & Cromwell (representing FTX debtors) or Quinn Emanuel’s clients, hired by FTX’s new management, acting as conflicts counsel. Both law firms are working to recover assets from the bankrupt exchange’s clients.

The community speculates on the timing of compensation payments

Work is underway to return funds to account holders affected by the FTX collapse. Amid speculation about the timing of the payments, information appeared on the network that FTX crypto holders could begin receiving payments as early as Sep. 30.

However, this was soon refuted — according to the latest data from the bankruptcy case materials under Chapter 11, the court is still studying a compensation plan.

The court filing shows that the next hearing to approve the restructuring plan is scheduled for Oct. 7. If the court approves the plan, payments for claims under $50,000 could begin in late 2024,

while others will receive compensation during the first half of 2025.

FTT Reacts With Growth

Amid the recent news, FTX has delighted investors. Hoping that the infamous crypto exchange would soon begin returning funds, investors have become more optimistic. Such an event could lead to an influx of $16 billion into the market.

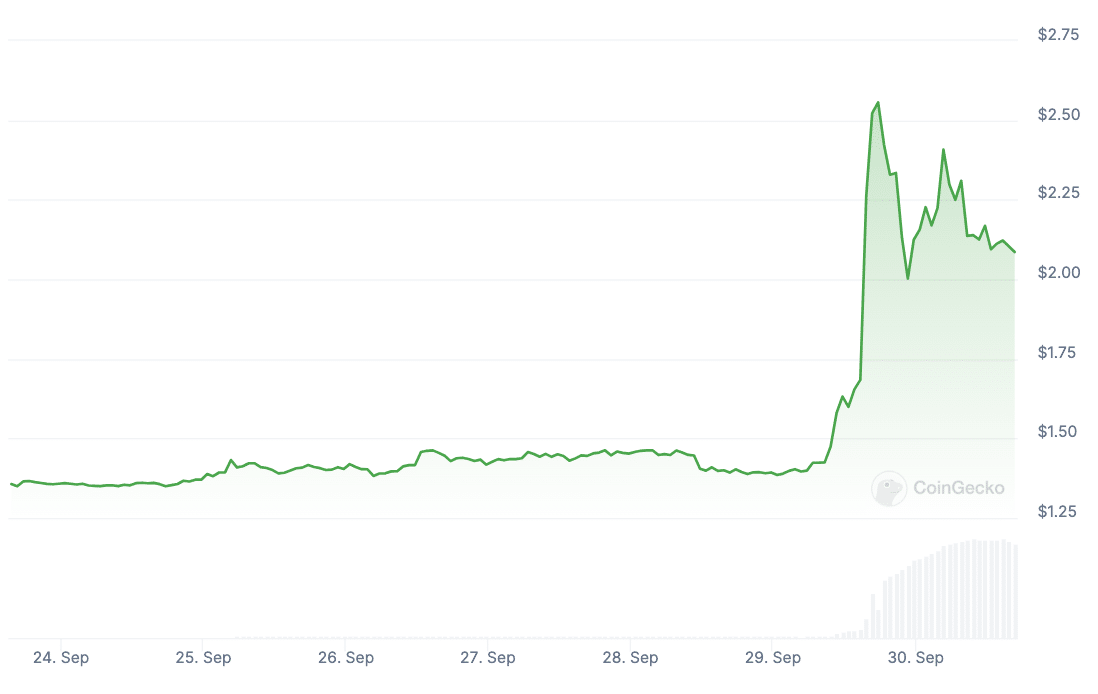

At its peak on Sep. 29, the FTX token (FTT) had gained 113% in a day. By the end of the day, the price had corrected and eventually dropped to $2.11 at the time of writing.

Where did the client funds go?

FTX, once worth $32 billion, used client funds for risky investments through its closely associated hedge fund, Alameda Research. Investigations revealed that the company used client funds to cover losses in other related businesses and finance risky investment deals.

FTX’s colossal budget deficit was discovered after clients requested their money back. After FTX’s bankruptcy, a restructuring procedure was initiated, and processes began to return funds to clients. However, at that time, the exact reasons for the disappearance of funds and where they were sent remained the subject of an investigation. In total, the exchange owes about $9 billion.

Victims are waiting, and the culprits are serving their sentences

FTX’s bankruptcy shook the crypto market and affected the prices of many coins. It also raised concerns among users and regulators about the security and liability of crypto exchanges. In addition to creating a refund plan, the exchange’s top managers are being punished one after another.

Bankman-Fried was charged with fraud, money laundering, and other financial crimes related to the management of FTX and client payments. The charges are based on the fact that he allegedly used client funds to support his other businesses, including the trading company Alameda Research. In March, he was sentenced to 25 years in prison.

Caroline Ellison, former CEO of Alameda Research CEO, was sentenced to two years in prison and forfeited $11 billion on fraud and money laundering charges. Her active cooperation in the investigation of Bankman-Fried mitigated the verdict. The judge emphasized that the collapse of FTX is one of the most significant financial crimes, and Ellison’s cooperation does not absolve her of responsibility. She admitted her guilt and apologized to the victims.

Following the verdict of the former Alameda CEO, other defendants are now awaiting court decisions: FTX co-founder and CTO Gary Wang, as well as head of engineering Nishad Singh.